Well, Lookie Here At This Criminal Enterprise (UPDATED)*

.

Customer Alfredo gave us the heads up on this little scam involving several Texas Congressvarmints.

Yesterday, the Financial Industry Regulatory Authority fined Southwest Securities $500,000 for using paid consultants to solicit municipal securities business and for violations of some other rules.

And it’s not the first time they’ve been in hot water. Last year they were fined $470,147 “to settle charges with the Securities and Exchange Commission for violating an anti-pay-to-play rule by co-underwriting Massachusetts bond deals within two years after its former senior vice president made political contributions to state Treasurer Timothy Cahill.”

And the year before that, they were in trouble with the SEC, who filed an cease-and-desist order against Southwest Securities for “failure to conduct compliance training for its financial services staff.”

Now, if you and I got into that much trouble yearly, we’d be in the pokey, or at the very least not operating a business.

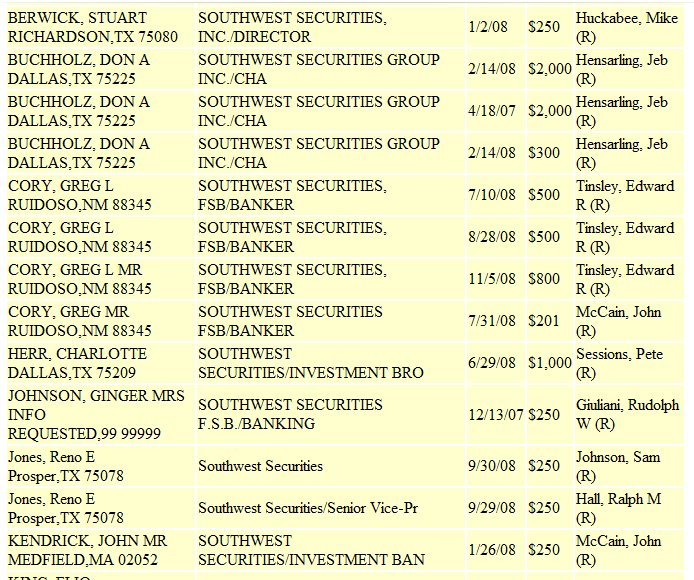

How did they get away with it? Well, have a look-see at this little Word document I made for you to see who is getting paid-off. Or, have a little peek at a partial list here. Click the little one to get the big one.

Other than one donation of $250 to Barack Obama, that there is a cashopalooza of Republican hands out.

Thelma says that they ought to allow the health inspectors to have campaign accounts so we could slide on that pesky “no homemade wine in beauty salons” rule.

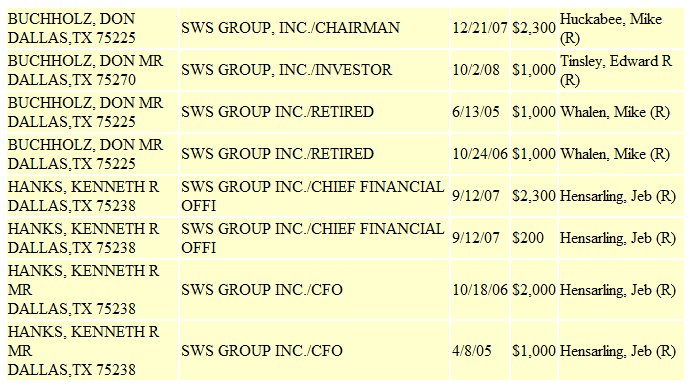

*UPDATED: Alfredo also found that Southwest Securities has sneaky down to an art form. Lookie here at the contributions under the name of their holding company. You know the clicking drill by now —

And, not surprisingly, Southwest Securities lobbied against regulatory reform.

No matter how cynical I get, I can’t keep up.

But wait, there’s more. Why all the money to

Jeb Hensarling? Southwestern Securities had good reasons to love Jeb back in 2006-2007. Jeb blocked legislation that could have prevented the financial crisis of 2008:

Rep. Jeb Hensarling, R-Dallas, is a member of the House Financial Services Committee and the sponsor of a pending bill to lighten the regulatory load faced by financial institutions.

He says the proposals could put a damper on community banks.

“When the regulators in Washington say ‘should’ or ‘might,’ it often comes across as ‘must’ to the examiner in the field,” Hensarling said.

Way to go, Jeb.

I don’t think this is the end of this story because the CFO of Southwest Securities suddenly resigned last October.

I’ll betcha that this story gets better and better.