Bonfire of the Treasuries

From 2011 to 2013, Americans were up in arms over the debt ceiling. The Treasury was statutorily unable to borrow any more money to pay for things Congress has already bought. Republican brinksmanship over what was normally considered a piece of housekeeping legislation led to US credit being downgraded. They were demanding policy concessions, wipeouts of program funds and other draconian cuts before approving anything.

If we reach a debt cap without any relief, the Treasury can take “extraordinary measures” to keep the government solvent and/or open. They can suspend statutory “investment” into certain pension or other funds in order to meet day-to-day operating costs. But that is merely a temporary stop-gap, buying you months, only.

The same problem raised its ugly head in 2015, but through a deal executed by Weeper of the House John Boehner and President Obama, the debt ceiling was suspended without any cap until a future date, at which point a calculated ceiling would be reinstated.

That future date, March 16, 2017, is upon us in 5 weeks.

The next day, the ceiling will be reset to cover all of the debt issued up until that time. That new ceiling is estimated to be $20.1 trillion. At that point, any new spending will not be covered by the ceiling. Experts estimate that extraordinary measures will keep us afloat until mid-summer, and then the United States of America will default.

Da Guy ostensibly in charge of all this made headlines last year by saying he would renegotiate the debts rather than raise the ceiling. By which he means renege on the debts and get the debtors to accept partial payments, which technically is what bankruptcy does. He vaguely walked it back when professionals pointed out he was talking out his ascot. Like all his vague walkbacks, he’s a little confused on what he believes, but he still thinks he’s right.

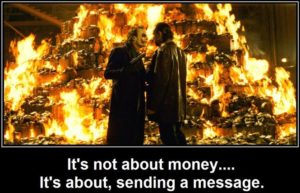

Toward that end, he has nominated for Director of the Office of Management and Budget (OMB) a 3-term backbench Tea Bagger from South Carolina who denies that the US can default, and the ceiling is all smoke and mirrors; Former Rep. Mick Mulvaney (R-Arson Hole, SC) wants to burn it all down:

MULVANEY: It depends, if we don’t make structural changes, if we don’t actually send the message to the markets, to the people to businesses that we’re going to be fiscally responsible then yeah I won’t vote to raise the debt ceiling I have no difficulty in doing that. I think it’s important that that message does get out and if that’s the opportunity we have to force a discussion on that issue then I say we do that.

Dat Guy’s nominee for Treasury Secretary, however, the guy who has to PAY for all these shenanigans, is Steve Mnuchin, a hedge fund and bank predator dude who, for all his corporate plundering, recognizes that most of his holdings won’t be worth a plugged nickel if T-bills, -notes and -bonds collapse. He wants this debt ceiling thing taken care of immediately, if not sooner. Suspend the ceiling or raise it, he doesn’t care which, so long as he’s not responsible for a global bonfire of the Treasuries.

This means that, once again, the White House is in the middle of a crisis it can’t understand, beset by the voices of corporatism on one side and nihilism on the other. The key players aren’t even in place yet: neither has been confirmed by the Senate, although both have passed out of committee. For that matter, the appointment and hiring of executive branchers is so far behind, that even in the West Wing people are rattling around like six dried peas in a quart tin can. So there’s no one to deal with the burgeoning tragedy.

Mixed messages and a dim understanding at the top. Mixed messages and competing visions among the staff. Empty heads in the West Wing; Empty desks throughout the Executive branch. The United States is going to default on its debt in 5 weeks.

It is unclear whether the United States Government is going to let it do so, or not.

Meanwhile, Nero Twittles.

What if Nero would have had Twitter instead of a fiddle?

1And they want tax cuts. These flaming shame ‘fiscal conservatives’ need daily reminders of how Ike paid for WWII and created prosperity. Until they own Dubya’s two wars on the national “credit card,” and revise the tax code to pay for those wars, it will continue to be band aids to a bloodbath lunacy.

Trim the budget, Donnie? Start by trimming the fat in your residences. And, quit planting Ospreys in the desert after dinner with Jared. BTW Did you pay for his dinner, or is he mooching off the tax payers for his grub?

2Deficits don’t matter when there is a Republican POTUS.

They only matter for black or Democratic POTUS.

That’s called a “fact”.

3Challenge accepted:

Agrippina died of suicide. Lyin Seneca and his #FakeHistory say I killed my OWN MOTHER! Disgusting!

I have won an Olympic crown for my chariot racing. FAKE NEWS says I never finished the race #MRGA

Germans are sending drugs, they’re sending crime, they’re rapists. I will build a VALLUM!

4Primo. Well stated. I couldn’t add a thing.

5A nitpick:

“…then yeah…”. The man said “yeah”? In a confirmation hearing?! Did he give it that Southern slide where it turns into a multi-syllable word?

Sweet Lord! What truckstop did they wander into to find these people?

6Primo –

I heard there’s another movie coming out, a sequel in a way:

Fahrenheit 452

Tag Line:

7Money burns hotter than books

We start the descent into the debt ceiling/default wet dream of these clods in five weeks. Even the market won’t take notice until months later. But heaven help us if the tax cuts land in that window.

8Republican math:

Less revenue (tax cuts) + Higher spending (did you say “Wall?”) = Balanced budget and no debt!!!

How can anybody vote for a political party that failed 4th grade arithmetic? Is our children learning? Apparently NOT!

Aaaaaarrrrrgggghhhh!!!!!!!

9I don’t know squat about economics, which apparently qualifies me to be a GOP with lots of loud opinions on it.

Oh wait, I knew one thing: that housing prices could not keep leaping up and up without having a crash sooner or later. I was surprised at how many professional economists didn’t seem to know that in 2008.

Nero’s chariot race in the Olympics: if I recall correctly, Nero fell out of his chariot, and all the other competitors stopped and waited for him to get back in because they knew what was good for them. He got a bunch of FakeMedals.

10Well, that’s one way to be rid of the rethuglicans except that it would wreck the country. Hello depression. The GOP owns this one all by themselves. Not the way I’d choose to show the country that taxes on the wealthy are very necessary. Those taxes should be 50% on the most wealthy. Maybe when the defecit is paid, the infrastructure repaired and people have resources they require to live we can reduce that to 49%.

11Trump & Co. are so out of their league, it’s frightening, and they aren’t aware of their shortcomings. Add to this a president who is obviously mentally ill and we’ve got a recipe for disaster.

12JAK that quote was from the time of one of the previous manufactured debt limit crises, when he was diving at reporters all anxious to be somebody. He was saying proudly to the world that he would vote his vote in favor of destroying it, financially speaking.

13JAKvirginia: My son is a well-read raconteur and former Marine sniper instructor who likes his long haul truck-driving occupation because it gives him lots of time to think, and lots of scenery and truck stop acquaintances to talk to over salads and Pinot Noir.* Please don’t generalize.

*That would be DUI tho.

14Defaulting on US Treasury Debt would have many consequences, some foreseeable, some not, but in ensemble they would be disastrous and would go a long way to destroying the US and World financial markets for a generation.

First, let me point out default on US Debt violates the Constitution. The first sentence of Article XIV, Section 4 of the US Constitution:

The validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions and bounties for services in suppressing insurrection or rebellion, shall not be questioned.

Second, the market US Treasury bills, notes and bonds is the largest and most liquid bond market in the world. Banks, pensions funds, insurance companies, foreign governments, other Central Banks, and many investment companies hold and trade vast sums of these securities every day. They each rely on that implicit promise not to default Let us assume for the moment that the US defaults and all Treasury notes and bonds lose 30-40% of their value. In that case the giant sound you hear would be your pension, your 401(k), your investment portfolio and every other security you hold immediately losing most of its value – including your house. In addition, by law and by regulation, life-insurance companies hold enormous sums of US Treasury bonds to match their liabilities. All of these companies would suddenly be under water, so all life-insurance contract is now worthless.

The disastrous consequences continue: without a functioning US Treasury market, banks are suddenly severely under-capitalized and are unable to lend at any price; the Federal Reserve will almost certainly cease to function; and the world’s stock, bond and commodity markets will dry up. If you believe it is tough for small businesses to borrow now, just wait until after a default. “Brother, Can You Spare a Penny?” will be the appropriate post-apocalyptic question.

In short, defaulting on US debt is short-sighted, stupid, apocalyptic, un-Constitutional, idiotic, and disastrous.

15Remember what Bill Clinton said one time at a convention? It’s all about “arithmetic”. Apparently the R Dudes and Duddettes failed first grade.

16I never, even in my scariest nightmares, thought I would be grateful to Steve Mnuchin as a voice of reason and sanity, and be rooting for his immediate success. Apparently, if he stays solvent, we all do, and if he doesn’t, we’re doomed. Go, Steve (Gag)!

17Um. There may yet be light in this tunnel:

“This means that, once again, the White House is in the middle of a crisis it can’t understand, beset by the voices of corporatism on one side and nihilism on the other.”

Who does pResident tRump listen to even more than the voices of nihilism? Why, that would be the voices of corporatism — so long as they aren’t corporate real estate, of course, who compete against His High-n-Mightyism.

So if the corporate realtors will sit down and shut up, we might just pull through this.

18Nobel Laureate PAUL KRUGMAN has been ripping the Deficit Hawks and Scolds and other Very Serious People new ones for years about crying wolf over large borrowing resulting in runaway, Wiemar-style inflation, when the true facts (seems I recall a not-too-distant time when the ‘true’ would have been redundant, no more!) put the lie to that. I shudder to think what a debt default would do to the World’s Reserve Currency. Maybe I need to pay more attention to fear-mongering ads for gold, seeds, weapons, ready-to-bury survival bunkers, etc.

19My opinion on this is, too many people don’t know how to do anything useful or even fun. When things are going well, people still need to know basics like gardening, building, sewing/knitting and related issues, reading and writing, making power sources including human and animal power, food preservation and how our grandparents got along (use natural shade and natural light, saving water, using a minimum of water and generated power.

20When things are catastrophic people MUST know how to do these things as well as being good neighbors and trustworthy. Call it whatever you like.

This is scary. I mean, that’s our retirement money and the money we don’t spend fixing things or visiting our kids. It’s not a good bedtime story. What is most likely going to happen?

21