US Debt – The Difference Between Manure and Filet Mignon

Yesterday morning on CBS, James Baker was interviewed about a number of issues including the escalation of war threats between the idiot in the White House and the idiot running North Korea. The issue he focused on, though? The “ticking debt bomb”. He warned of the unsustainable level of debt that is almost 100% of GDP (a measure used by economists), asserting that we must cut “entitlements” to get it under control. I asked myself, “Is that really true?” I’ve taken a simpleton’s approach to this question, just using math, not political spin. For the purpose of this discussion, I’m going to ignore defense and other discretionary spending – that’s a whole other kettle of fish and a subject for a future post, probably after I’ve been drinking.

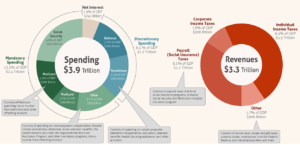

So I looked at a couple of things: First, I assume entitlements to Baker mean Social Security and Medicare. Are they actually part of the federal budget? The answer is yes, but have a separate source of funding through social insurance taxes. Here’s the CBO chart for 2016 (click on the little one to get the big one):

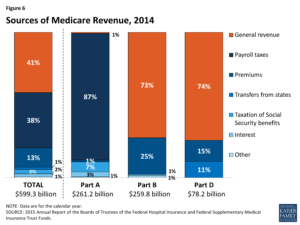

Some interesting things here. First, personal income taxes make up almost half of revenues, about 8.4% of GDP. Amazingly, corporate taxes are on 1.6% of GDP, near all time lows. In the 40s and 50s, that number was 4 to 5%. On the social insurance tax revenue side, those total $1.1 trillion, about 6.4% of GDP. Part of that $1.1 trillion is supposed to go into the Social Security trust fund and benefits paid from that. The other part, about $400 billion goes to Medicare. Pretty straightforward, right? We’ll see.

Where it gets messy is on the spending side. Social Security and Medicare make up $956 billion in federal spending. Medicaid, on the other hand, is funded partly by the states and partly by the federal government. The federal funds for Medicaid come from general revenues.

Now look at the left hand circle on the CBO chart. Of discretionary spending, defense is HALF. If you throw in veterans benefits that are part of non-discretionary spending blows it up even more. (We’ll talk more about that later). The proposed budget increases that spending even more while slashing funding for Meals on Wheels, after school programs, and Medicaid.

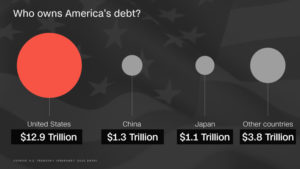

Now, let’s talk about who actually owns US debt. China, right? Well, yes, but not the amount you always hear about from Fox Noise and the idiots in the Congress. The largest holders of US debt? Us. Americans. Some of us buy US bonds. Corporations own US bonds. But the largest holder of US bonds? Government trust funds including the Social Security trust fund. Over $5 trillion. That’s right, over the last 30 years, instead of raising taxes to cover spending, politicians that we elected have been stealing money from the trust funds, replacing that cash with…wait for it…US debt. Here’s the most recent breakdown of US debt holders.

Now, back to the so-called “debt bomb”. Baker rang the alarm bells that our debt is going to consume us and push us into bankruptcy. He claims that cutting “entitlements”, even the ones WE’VE ALREADY PAID FOR, is the only way to reduce our debt level. That is simply a lie. Here’s an interesting chart from Advisors Perspectives by Doug Short. It plots debt to GDP by year which Baker is so worried about, but also charts this data against historic tax brackets. Have a look:

Now ain’t this interesting? Debt to GDP exploded while our parents funded WWII. In response, the government, then apparently run by adults, raised taxes to pay down the debt and grow the economy. During those years of high tax rates, do you remember all that poverty, bankruptcy, and insolvency? Me neither. The higher tax brackets ushered in one of the most dynamic periods of our history, creating the middle class and prosperity that reached deep down into our society. What happened after Reagan started slashing tax rates in the 80s? That’s right, debt to GDP started to skyrocket again. The only problem we have today is that “experts”, like Baker, Reagan, GWB, and the current occupant of the White House didn’t and don’t understand math. They believe as an article of faith that cutting taxes raises revenue, and that slashing spending increases prosperity.

The opposite is true. It’s always been true, but since everyday Americans have been dumbed down to the point that they believe horse manure is filet mignon, hacks like Baker get away with serving it up unchallenged on national television. We don’t need draconian cuts that throw Momma off the train, all we need is for the clowns in DC to study this:

So there.