I Have a Plan

So, we didn’t do diddle squat after the last bank bail out, and now we’re all surprised that there’s another. Yes another, who incidentally gave enormous bonuses to their top executives a couple of hours before padlocking the front door.

I have a solution. No bail out.

Here’s how we handle it. We have all of their executives show up at the bank for a “party.” Once they arrive we strip them down to their boxers and hand them a big box with all their money in the world, except for $250,000 which we allow them to keep, and then open the door to account holders.

It would be a mess, but we’d never see a bank fail again.

Oh yeah, we also give a microphone to Elizabeth Warren so she can remote broadcast color commentary of the big event.

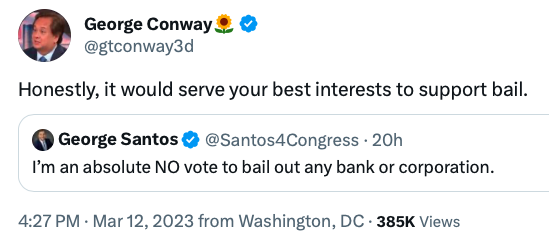

A friend sent me a tweet that makes me chuckle.

Hope your Monday has some good news.

Made me laugh!! You almost owe me a new laptop!! Luckily I had just swallowed my mouthful of coffee!

1I’d pay good money to see that!

2Haha yes JJ for President, ‘Idea’s that work!’

They failed because of tRump deregulation and risky bet on Crypto you say??? Jeez if I knew my bank invested in Crypto, I’da sell them some swampland in Florida and a bridge in Brooklyn.

But ‘Let the Markets decide’ until we’re all broke and poor.

Some Liberal blog info …

‘How to Think about the Silicon Valley Bank Collapse’

https://talkingpointsmemo.com/edblog/how-to-think-about-the-silicon-valley-bank-collapse

‘Wall Street pal Larry Summers borrows NRA language to say now isn’t the time for ‘moral lectures’ on bank failures’

https://www.rawstory.com/banks-larry-summers-regulations/

‘ABC Host Rips Regulation Cuts ‘Under President Trump’ After SVB Bank Collapse’

3https://crooksandliars.com/2023/03/abc-host-rips-regulation-cuts-under

Would be fitting if Santos has money in Signature bank.

4Also, the ceo of the SV Bank sold his stock ($3.8 million) in the bank days before it collapsed. Hmm. Guessing some of the other executives in that bank did the same. A little insider trading?

Just to be clear, quoting Heather Cox Richardson’s post today:

… Secretary Yellen has signed off on measures to enable the FDIC to fully protect everyone who had money in Silicon Valley Bank, Santa Clara, California, and Signature Bank, New York. They will have access to all of their money starting Monday, March 13. None of the losses associated with this resolution, the statement said, “will be borne by the taxpayer.”

But, it continued, “Shareholders and certain unsecured debtholders will not be protected. Senior management has also been removed. Any losses to the Deposit Insurance Fund to support uninsured depositors will be recovered by a special assessment on banks, as required by law.”

5During the tfg reign, sixteen banks went under – did you hear about them? Depositors should get their insured amount, but the government (us) don’t need to insure against business risk.

6News flash- according to Floriduh premier desantis, the SV Bank folded because they were “woke”. He neglected to mention a major investor in the bank was Peter Thiel, the big repugnantican and TFFG supporter, pulled his money days before, just like the bank ceo.

7I admit, I have always enjoyed George Conway. He may be a skunk with terrible taste in women, but he’s a funny, and often highly accurate, skunk.

8SMH, I keep my funds in credit unions. When the banks went down in the Great Depression, the credit unions survived.

thatother jean@ 8,

I enjoy Conway, too. According to an article in the Guardian today, sounds like banks overseas are spooked by SV bank collapse.

9Conservative Capitalism – Privatize the profits, socialize the losses.

Oops both siderism..

‘Katie Porter Explains What Happened With Silicon Valley Bank.

She has a depth of knowledge about financial regulation’.

“I saw how Wall Street wielded political power to rig the rules against working people, and how they rarely took responsibility for their own (frequent) mistakes”

10https://crooksandliars.com/2023/03/katie-porter-explains-what-happened

JJ, I have to call you on your first statement. Something was done after the 2008 bank bailout, the Dodd-Frank regulations. And had that been left in place, Silicon Valley Bank would have been prevented from taking on the risks that led to the bank run. But of course, Trump, the Republican led Congress, and far too many Democrats decided to change the regulation threshold from banks >$50 billion in assets to Banks >$250 billion in assets. And the rest, as they say, is history.

11Sen Warren has an Op-Ed in the NY Times that lays out clearly the problems and the solutions to SVB and other banks.

12Sadly with so many ‘hired hands’ in Congress it is unlikely anything will be done.

Fortunately, the only folks ‘bailed out’ were the depositors, from funds the banks have to pay. People with stock or bonds on the banks lose….except, of course, for the Inside Traders.

So anyone who sold their stocks in the days before the collapse should be prosecuted.

13*Mr Santos* or someone pretending to be him – as no-one knows his actual name .

14Biden and the Democrats need to get way in front of this issue, and super-vocal about how the Rethugs have facilitated the whole mess. So far based on a bit of media sampling, the Republicans look to be ahead in blaming the Democrats.

.

Methinks that the markets are in for a wild ride down today. Hang on to your 401ks…

Asian markets are seriously off, near 3%, after a bad day yesterday, Euros sliding. Expect the US markets to take a big hit today, after an already extended slide down lately.

It ain’t gonna be pretty imo..

Even crude oil is crashing, and gold has been inching up, over 1900/oz since the last few days.

Light Crude 73.48 -1.32 −1.76%

Oh well, pump prices will go down, right?? Good for the inflation numbers eh?

Speaking of inflation, you never hear any damned Democrats mentioning how the tRump trade war against China has been a major factor in our inflation problem.

Starting with his idiotic tariffs and tax hikes on imported Chinese goods; remember, most of our imported crap comes from from China.

Slap tariffs on that trade and the Chinese DO NOT pay it, WE DO!

And I’m not advocating trade with China, mostly against it.

15But don’t ever forget who made China a major [‘the’ major?] world economic power [and now, naturally, a military power]: St. Ronnei Reagan, Henry Kissinger [R] and the Republicans.

President Biden said that no losses related to the collapse of Silicon Valley Bank or Signature Bank would be borne by the taxpayers.

16Vickie @16, That’s the worst kind of artful bullshit. Biden should be ashamed.

The bailout is being artfully obscured by hiding it in an FDIC bailout of the failing bank depositors who kept more than $250K in their accounts, most of them well over the insured amount of less than $250K. Not all were ‘insiders’ who got an early heads-up to jump clear.

The FDIC bailout money comes from fees imposed on all other banks, therefore indirectly from anyone who keeps money in a bank or other banking ties.

It will draw down the current FDIC reserves, then significant additional fees are imposed to cover the total bailout, again paid by the public who have bank accounts. Granted, not from ‘all taxpayers’, but most people have a bank connection [like mortgages, loans, etc], which will be impacted indirectly.

Those people* who had large deposits in the failing banks had them because those banks were offering better ‘terms’ than other, more cautious and responsible, banks/financial entities. Therefore ‘theoretically’ taking more risk to possibly gain more.

Except, once again, our feckless politicians step in to grossly and unfairly “privatize the profits, socialize the losses”.

And we –all– get screwed once again.

* I had first-hand knowledge of the same shit back during the first S&L crash.

17Many associates had been bragging for a long time about how much ‘extra’ money they were making from their S&L deposits [over we who stuck with the CU or banks]. The S&Ls were able to do this [for a while] because of a certain type of ‘deregulation’ that allowed them to do some very risky things. With a real estate stumble, the grossly overextended S&Ls were screwed.

When the bottom fell out of their baskets they were screaming bloody murder.

I caught a lot of shit from them by pointing out what was happening, and why we shouldn’t bail their sorry asses out. F’em all…

Excellent take on the ‘bailout’:

https://www.dailykos.com/stories/2023/3/13/2157908/-Shouldn-t-the-Silicon-Valley-Bank-transaction-be-called-a-bailout

18Crude is getting hammered today, it’s been bouncing around for the year, trending down, but not this bad [heading for sub-$70/bbl ?]. Looks like recession spookville?

US markets opened up, but are heading down this afternoon.

Light Crude 71.08 -3.72 −4.97%

19Oops:

20Light Crude 70.95 -3.85 −5.15%

I’m hoping the SEC insider stock trading rules apply to the management — and perhaps some bigger customers — in this case. Trading on insider information gets one 3x the profits made or 3x the losses avoided. Some of my coworkers at a startup got deposed for this, and fined hugely when they traded on information that our largest gov’t customer was likely to dump us (which they did).

21“Trading on insider information gets one 3x the profits made or 3x the losses avoided.” -> “Trading on insider information gets one *fined* 3x the profits made or 3x the losses avoided”.

22There isn’t any bailout. If John Dillinger robbed the bank where you kept your $100, and the cops recovered the money and gave it back to you, would you call that a bailout?

23Harry Eagar @23, WTF??

Don’t think that you know how the financial systems work Harry.

Your $100 [in this case, greater than $250K, since lesser amt is insured] deposit didn’t simply stay in the bank’s vault after you left it.

It was immediately portioned out in various ways, or leveraged to others.

When the bank [SVB] cratered, it’s assets [your deposit et al.] was either slickly absconded or simply evaporated in the leverage implosion [yes, money can just evaporate, although it’s usually transferred to some insider’s pocket]. And in your simplistic analogy, John Dillinger is actually the SVB executive group and all the Wall Street wizards, plus a bunch of politicians and regulators.

The “cop” FDIC might be fixing to take $100 [$250K+] from somebody else and possibly give you your $100 [$250K+] equivalent back to you, but you’re not entitled to it [your ‘moral hazard’].

But it may/will come out of some innocent third party’s pocket in the form of a bailout to you, who by the terms agreed to, aren’t eligible to get anything beyond $100/250K returned to you [some of those deliberate risk-takers went way beyond, into the Millions; not even mentioning the likely criminal insiders].

Oh, you’re talking about the ‘non-bailout bailout’…

Bailout NOUN

an act of giving financial assistance to a failing business or economy to save it from collapse.

.

24BTW, there’s a really scary PBS Frontline2 show running called “The Age of Easy Money” that might be worth watching; if you can stand having your hair and shorts spontaneously combust.

It left unsaid that –when– we in the USA [#1#1#1…] have a financial meltdown like never before, RSN, –that the Red Chinese will be the ones who bail our sorry asses out and will then OWN us [they’ve already made a huge headstart buying up US assets].

Yes, unlike us, they have trillions of real dollars and equivalent hard assets stashed away [of which much used to be ours, TYVM, St. Ronnei].

They’re just patiently waiting for our genius financial wizards, and politicians, to finally implode the whole fucking mess..

Forgot this, just started reading it, verrry long and interesting :

https://en.wikipedia.org/wiki/Bailout

25I was a business reporter for 45 years. I know what I am writing about.

Depending upon just what was on SVB’s books, the gummint might well make a profit out of full coverage. All those Treasuries that were on the books at 80 out of 100, or whatever the ratios were, when the gummint takes them over, they’re worth 100.

It doesn’t work for anybody else, but for the gummint, it’s like buying dollar bills for 80 cents. (Present value calculations can be disregarded since the gummint is always in debt and will now reduce its current borrowing by the face amount of the bills.)

Also, debtors to SVB are now debtors to the gummint and since (apparently), most are capable of paying their notes, eventually the paper loss may disappear anyhow.

26Meanwhile, back at the ranch,

WTI crude was under 66bbl at noon today, since slightly recovered to ~68 now [Eagle Ford crude ~63, rig probs coming around these parts, iirc local breakeven price is ~65]. Markets treading water +-, so far..

Analysts thinking the SVB dustup is spooking everything, given the current downside potential [of which crude is an important indicator]..

.

Harry, 45 or whatever, you’re not very clear on what you’re dancing declarative about. I selected, trained, motivated, led teams of people to perform extremely technical and dangerous tasks with no room for errors or bullshit. Clarity was essential. For 35 and out at 54…been enjoying retirement since.

If you’re comparing the SVB thing to 2008, TARP, GM, Dodd-Frank, etc. [yeah the gubmint made a little profit on some of the bailouts/bailins, but that set the stage for worse to come, especially when regs have been weakened since]. It’s a small potato, but indicative of much bigger and worse crap just under the surface.

Watch this and get back, pay attention to what they say, and even more to what they don’t quite say… have your Nomex undies on and a fire extinguisher handy.. :

FRONTLINE

Age of Easy Money

Season 2023 Episode 4 | 1h 54m 22s

https://www.pbs.org/video/age-of-easy-money-osu8cj/

“The role of the Federal Reserve’s “easy money” policies in the current economic uncertainty. From the Great Recession to the rise in inflation, FRONTLINE examines the ongoing fragility of the financial system and the widening gap between Wall St. and Main St.”

27BTW, to lighten up on the tailend of humpday, here’s a pic of some of my neighhhhbors [pic from my NextDoor, sry for the length of the link]. Better than most, but you know what also hangs around agri areas…gotta use a lotta bug spray..:

https://us1-photo.nextdoor.com/post_photos/be/43/be430d974be7843e22a1850b6fd8aafb.JPG?request_version=v2&output_type=jpg&sizing=linear&x_size=7&resize_type=resize

28Oh, we’re sharing photos of our neighbors?

Here’s one from near my location in Anchorage:

https://www.youtube.com/watch?v=HNfetnUwOUo

29The money you deposit in the bank isn’t the bank’s money. It’s a loan, although that isn’t how we usually think of it. I do not wish to get into an argument, and you are far from alone in your misapprehensions, but savings book holders are not opening themselves to moral hazard. Financial hazard, yes, but moral hazard, no.

30