Harnessing The Cramer Effect

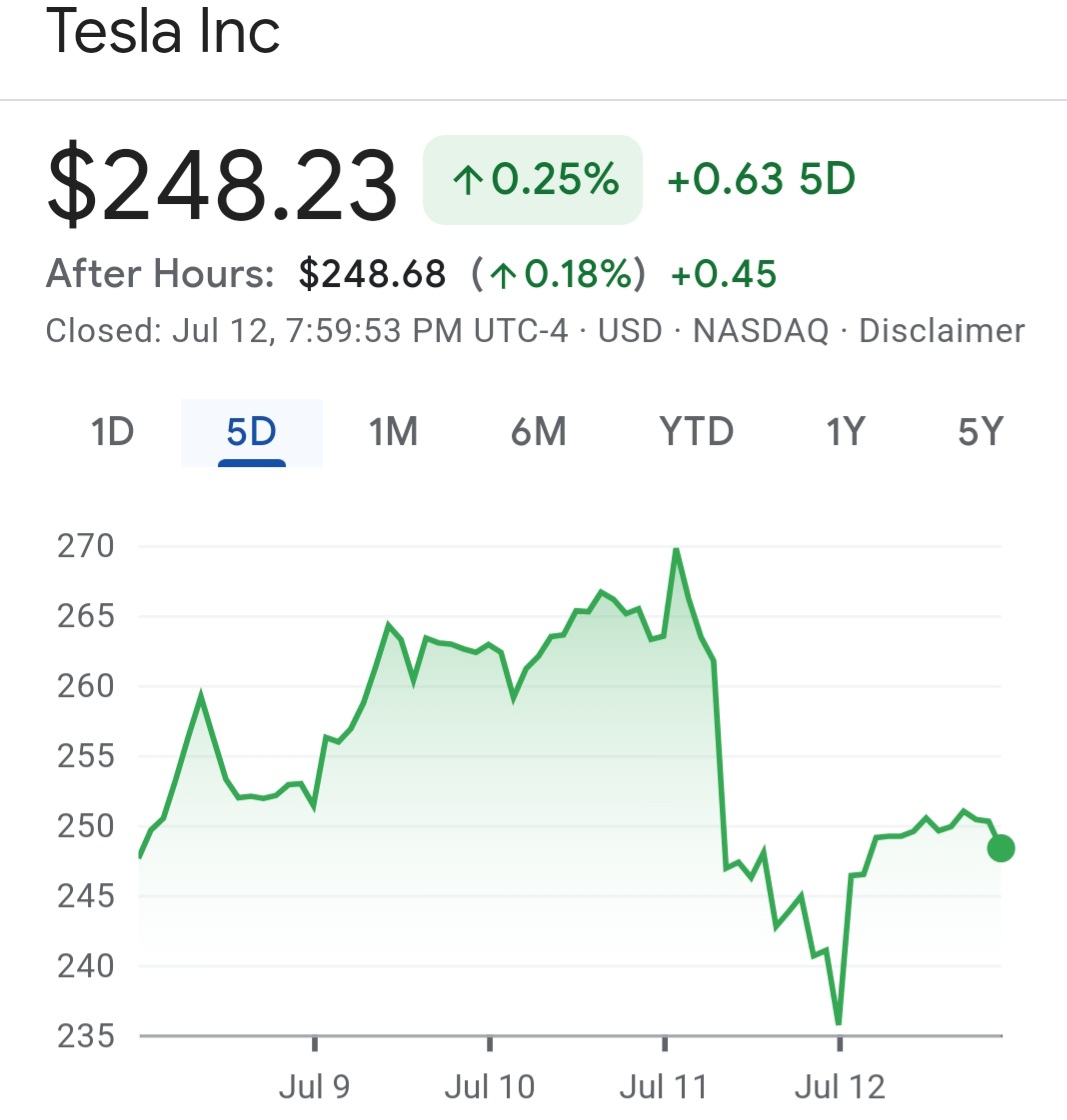

This past Thursday, Tesla stock took a hit that no one was expecting. Here’s a plot of the stock’s performance over the past five days.

At one point on Thursday, Tesla had lost $105 billion in value.

At one point on Thursday, Tesla had lost $105 billion in value.

Was there a bad news statement on production problems? None reported. An auto safety issue? No. Was there a bad quarterly report? Not even close. Did CNBC business reporter Jim Cramer recommend a strong “Buy” for Tesla stock?

Bingo.

This is known in business news circles as “The Cramer Effect” or more to the point, “The Inverse Cramer”.

Who urged a strong buy of Bear-Stearnes just before the 2008 mortgage crisis? Jim Cramer.

Who promoted FTX just before its founder, Sam Bankman-Fried, was arrested for fraud? That was Cramer.

Who touted the dot com companies just before that bubble burst? Jim.

There is even an Inverse Cramer Index that tracks his recommendations.

Now, can we get Jim Cramer to recommend a strong “Buy” for TFG?

Bingo.

“If you think that Trump’s more likely to be president, the overall tone of the stock market will improve if only because the man can’t bear to see it go down, as the major averages are the barometer he uses to measure his own job approval,” Cramer said. “You may think that’s insane, but it’s the reality, and if nothing else — hate him or like him – he’s good for your portfolio.”

I like that. Vote for the serial rapist and convicted felon, so your stock portfolio goes up because TFG will be so mad if it doesn’t.

Inverse Cramer predicts a strong Biden victory.

Booyah!

Tesla stock is seriously overvalued. Tesla’s products and their delivery of same has been poor. The Cybertruck was a disaster, and that disaster is still ongoing.

It is a bubble, just like the DotCom bubble in the late 90s, the real estate bubble in 2005-2007, and so many others during Trump’s term.

Now and then someone points that out, and the crazy stock price drops a bit, making its billionaire investors poorer … on paper at least.

The whole bubble is going to pop one of these days. But the billionaires and corporations investing in Tesla will be bailed out -again- by the Fed Gov. Smaller investors might as well have invested in “Truth Social”

1And a nifty “dead cat bounce” on Friday. I wonder if Cramer caught that one.

2The stock market will go up if Trump is elected prez? Because he can’t stand it to go down? That sounds like some serious market manipulation that should be looked into by the Securities and Exchange Commission- – but not before Trump stuffs it with his own people, in a presidential act.

Back to Tesla, I read recently a young Elon Musk wanted to send a mouse to Mars in 2001, launched on a repurposed Russian ICBM. But after the vodka toasting negotiations he misunderstood the price was not for three rockets, but one. The Russians laughed at him and spit on his shoe.

3Katherine Williams @ 1

Truth. The capitalization per Tesla sold is about 100 times higher than per Ford or GM EV sold.

The market is not rational but those numbers eventually count.

Cramer is a buffoon.

4You have a special talent for storytelling.

5