An Open Letter to Mark Warner

Some people were shocked that Virginia Senator Mark Warner was one of the two Democratic votes against the amendment for a middle class tax cut on the tax bill.

They shouldn’t have been.

Here is a letter left on the front door of the beauty salon.

An Open Letter to Senator @MarkWarner

Senator, I do apologize for the length of this letter, but as a relatively influential Internet personality who aspires to public service, I have a couple of questions that I’m hoping you can answer for me.

First, allow me to provide you and my readers some context.

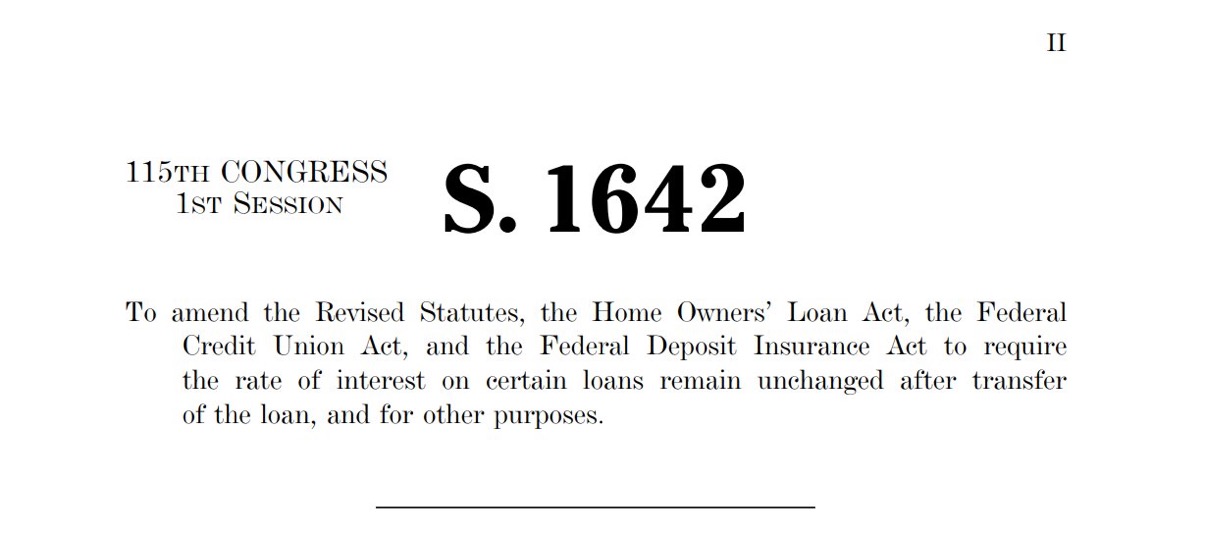

Since the start of the session, you have been tirelessly working towards completing your pet project, S. 1642:

Considering that you’re a Democrat, one might quickly read that title and think that you’re working on a bill to protect consumers in the lending market.

But you and I know they would be so incredibly wrong.

You wrote this bill to create a method for payday lenders to evade state interest rate caps.

Its sole purpose is to neuter a decision by the 2nd Circuit in Madden v. Midland, which enforced state interest rate caps against non-banks (such as payday lenders).

It nullifies the primary tool against predatory lending practices by payday lenders. Splinter’s @libbycwatson summarized the situation well in a mildly profane but fair reaction piece:

You’ve publicly defended the bill by arguing that state interest rate caps have reduced access to credit by low income borrowers.

Your lobbyists point to a study showing a decrease in lending by three lenders following the Madden decision for those with FICO scores below 650.

But the study showed that these lenders offered only miniscule amounts of credit in that FICO range even before the Madden decision. Your lobbyists know the actual impact on access to credit was trivial.

I’ve seen the full text of the study, as I am sure your staff has.

And I’m sure someone on your staff is capable of explaining the “Before Madden” and “After Madden” charts on pages 43-54.

So we both know the score, Mark. Thank

Not to mention, all this academic stuff ignores the more fundamental question of whether the moral solution to credit access for risky borrowers is to deregulate the payday loan industry.

After all, if you wanted to increase credit to risky borrowers, why not get rid of federal wage garnishment restrictions and the Fair Debt Collection Practices Act?

Or at the very least extract meaningful consumer protections by leveraging the industry’s throbbing desire to scrap Madden? Just spit balling here…

There are a thousand ways to increase credit access that don’t require you to unleash a frightful clutch of vampires upon our nation’s most vulnerable residents.

You know this will hurt people. More than 150 state and national consumer organizations put it plainly: “This bill is a massive attack on state consumer protection laws.”

And oddly enough, you supported state interest caps on payday lenders back in 2008 when you were governor of Virginia:

Yet here we are.

Mark, you are one of the most powerful public servants in the country, a figure of genuine influence in a society where influence is a hoarded currency.

And speaking of hoarded currency, I understand that you have personally accumulated a quarter of a billion dollars. You are balling on Jay-Z levels.

By all accounts, you should be beholden to no one.

So I just can’t understand it.

I cannot understand, with the power at your disposal and the amount of easily erasable misery in the world, why you would ever spend a single moment thinking about the plight of the perverse payday loan industry.

The only possible answer is an abject degeneracy so extreme that it seems overly coarse to raise in an open letter to people…

So maybe you can explain something to me.

I am a fairly accomplished plaintiff’s lawyer in my 30s, and like you I grew up in Democratic politics. There’s a fair shot that I’m heading for elected office.

Almost certainly not something so lofty as the U.S. Senate, but an appellate bench or state office perhaps.

And I am sure that once in the corridors of power, some of my more naïve conceptions about civil service will evaporate.

For if I ever held an office so venerated as yours, I might, in my zeal to leave my mark on history, resolve difficult questions about my core values in ways I might find surprising today.

But I cannot imagine suddenly finding myself in the position where I had become a splotchy middle-aged used car salesman pitching for the payday loan industry into a pair of iPhones…

Because if I did, Mark — if I ever looked in the mirror and reached that epiphany — I would 100% slit my wrists in a bathtub while listening to Pink Floyd’s “Great Gig in the Sky” on repeat.

But that’s not your style Mark. You’re some kind of different creature. Something I can’t understand.

And I confess no small amount of anxiety about venturing into political life because of that.